mississippi income tax payment

Individual Income Tax Return using the Wheres My Amended Return. Keeping you informed on how to handle buying selling renting or just nesting at home as we adapt to life during COVID-19.

Conservative Think Tanks Business Advocates Call For Income Tax Elimination In Mississippi Mississippi Politics And News Y All Politics

TAX DAY IS APRIL 17th - There are 175.

. Notable 2021 State Individual Income Tax Changes. Individuals and corporations are directly taxable and estates and trusts may be taxable on. Unlike adjustments and deductions which apply to your income tax credits apply to your tax liability which means the amount of tax that you owe.

In the following table we provide the most up-to-date data available on state individual income tax rates brackets standard deductions and personal exemptions for both single and joint filers. Forty-one tax wage and salary income while New Hampshire exclusively taxes dividend and interest income and. While working over 18 years at the IRS and in private practice helping taxpayers like you Michael has personally resolved.

TAX DAY IS APRIL 17th - There are 175 days left until taxes are due. HR Block has been approved by the California Tax Education Council to offer The HR Block Income Tax Course CTEC 1040-QE-2662 which fulfills the 60-hour qualifying education requirement imposed by the State of California to become a tax preparer. Youre eligible for the deduction if you paid student loan interest in the given tax year and if you meet modified adjusted gross income requirements your income after eligible taxes and.

Income Tax Returns With Payment Quarterly Tax Payments Illinois Department of Revenue Springfield IL 62726-0001. Individual income taxes are a major source of state government revenue accounting for 36 percent of state tax collections in fiscal year 2020 the latest year for which data are available. Both tools are available in English and Spanish and track the status of amended returns for the current year and up to three prior years.

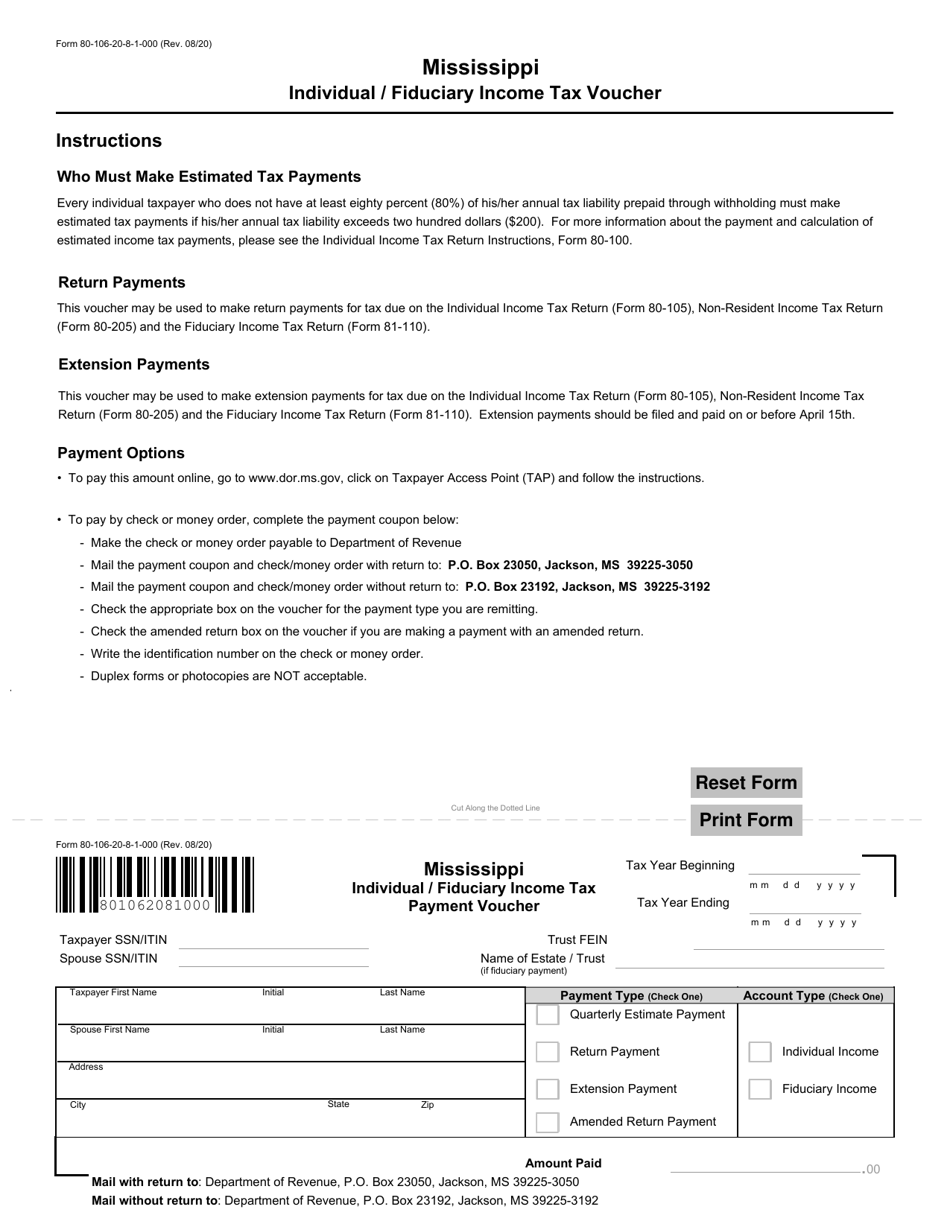

PO Box 29204 Phoenix AZ 85038-9204. 80-115 Declaration for E-File. Tax Payment Types Please select a Tax Payment Type.

Mississippi provides exemptions for retirees on all of the most common forms of retirement income. Submit Your South Carolina Tax. Online tool or by calling the toll-free telephone number 866-464-2050 three weeks after you file your amended return.

Several states changed key features of their individual income tax codes going into tax year 2021. If you are receiving a refund PO. 80-110 EZ Resident.

The Income Tax Course consists of 62 hours of instruction at the federal level 68 hours of instruction in Maryland 80 hours of instruction in California and 81 hours of instruction in Oregon. 80-106 IndividualFiduciary Income Tax Voucher REPLACES THE 80-300 80-180 80-107 IncomeWithholding Tax Schedule. 80-108 Itemized Deductions Schedule.

Estimated Income Tax Payment Voucher Form OR-40-V Oregon Individual Income Tax Payment Voucher 150-101-172 Clear form Form OR-40-V Oregon Department of Revenue Oregon Individual Income Tax Payment Voucher Page 1 of 1 Use UPPERCASE letters. If you are unable to refund the tax directly to the customer that paid the tax Mississippi law requires that any over-collection of sales tax by a retailer from the customer must be paid to the State. Work income earned by seniors is however subject to the state income tax.

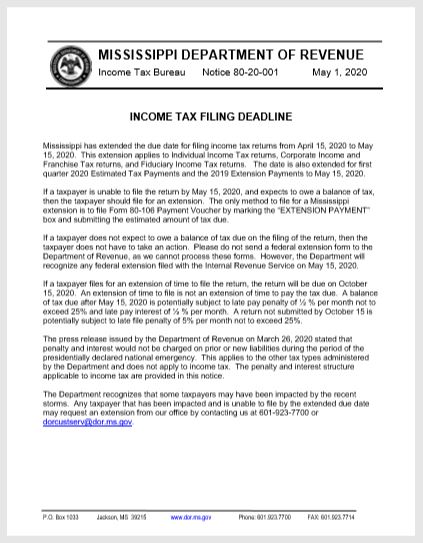

Following the recent disaster declaration issued by the Federal Emergency Management. Box 23050 Jackson MS 39225-3050. Get step-by-step guidance that will answer all of your questions on having your IRS tax debt expire by Clicking HereLandmark Tax Group is operated by Michael Raanan MBA EA an IRS-licensed Tax Relief Specialist Enrolled Agent and a former Senior IRS Agent.

Detailed New Mexico state income tax rates and brackets are available on this page. State restrictions may apply. Use blue or black ink.

When making a payment towards your taxes file this payment voucher along with your payment. Detailed South Carolina state income tax rates and brackets are available on this page. Learn more about filing a tax extension late payment and late filing penalties and what to do if you cant pay your taxes.

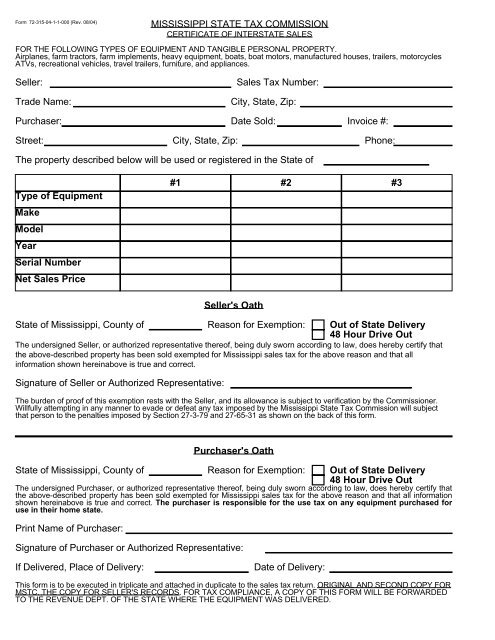

Corporate officers may be held liable for payment of the tax in the event the business fails to properly remit the tax to the state. Submit Your North Carolina Tax Return Online Visit North Carolinas eFile Program. For example if you calculate that you have tax liability of 1000 based on your taxable income and your tax bracket and you are eligible for a tax credit of 200 that would reduce your liability.

80-155 Net Operating Loss Schedule. Online is defined as an individual income tax DIY return non-preparer signed that was prepared online either e-filed or printed not including returns prepared through desktop software or FFA prepared. Income Tax Returns No Payment North Carolina Department of Revenue Post Office Box R Raleigh North Carolina 27634-0001.

Start filing your tax return now. Box 23058 Jackson MS 39225-3058. Detailed Illinois state income tax rates and brackets are available on this page.

MS-2022-01 September 2 2022. Print actual size 100. Income Tax Returns Payment Enclosed VT Department of Taxes PO Box 1779 Montpelier VT 05601-1779.

Additional time commitments outside of class including homework will vary by student. The Illinois income tax has one tax bracket with a maximum marginal income tax of 495 as of 2022. Detailed Vermont state income tax rates and brackets are available on this page.

Start filing your tax return now. Start filing your tax return now. Income Tax Returns With Payment Box 52016 Phoenix Arizona 85072-2016 If your return has a barcode.

Income from pensions 401ks IRAs 403bs SEP-IRAs and 457bs are all exempt in Mississippi. Income Tax Returns Without Payment. You can use this service to quickly and securely pay your Mississippi taxes using a credit card debit card or eCheck.

Welcome to the online Mississippi Tax QuickPay for Businesses and Individuals. You can mail your return to the at the correct address below and include your payment by check or. Are other forms of retirement income taxable in Mississippi.

The North Carolina income tax has one tax bracket with a maximum marginal income tax of 525 as of 2022. Income taxes in the United States are imposed by the federal government and most statesThe income taxes are determined by applying a tax rate which may increase as income increases to taxable income which is the total income less allowable deductionsIncome is broadly defined. The Arizona income tax has four tax brackets with a maximum marginal income tax of 450 as of 2022.

All other income tax returns P. Forty-three states levy individual income taxes. Detailed Delaware state income tax rates and brackets are available on this page.

Income Tax Returns Payment Enclosed Taxable Processing Center PO Box 101105 Columbia SC 29211-0105. TAX DAY IS APRIL 17th - There are 174 days left until taxes are due. WASHINGTON Victims of the water crisis beginning August 30 2022 now have until February 15 2023 to file various individual and business tax returns and make tax payments the Internal Revenue Service announced today.

The South Carolina income tax has six tax brackets with a maximum marginal income tax of 700 as of 2022. For filing and paying your income tax. Submit Your Arizona Tax Return Online Visit Arizonas eFile Program.

You can check the status of your Form 1040-X Amended US.

Mississippi Llc Tax Structure Classification Of Llc Taxes To Be Paid

Mississippi House Passes Tax Reform Proposal That Includes Phasing Out State Income Taxes

Can Mississippi Republicans Finally Deliver On Income Tax Elimination In 2022 The Northside Sun

Mississippi State Income Tax Ms Tax Calculator Community Tax

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZGQL7TXAKZESPG35EFTKAHTZWQ.jpg)

Education Advocates Critical Of House Income Tax Bill

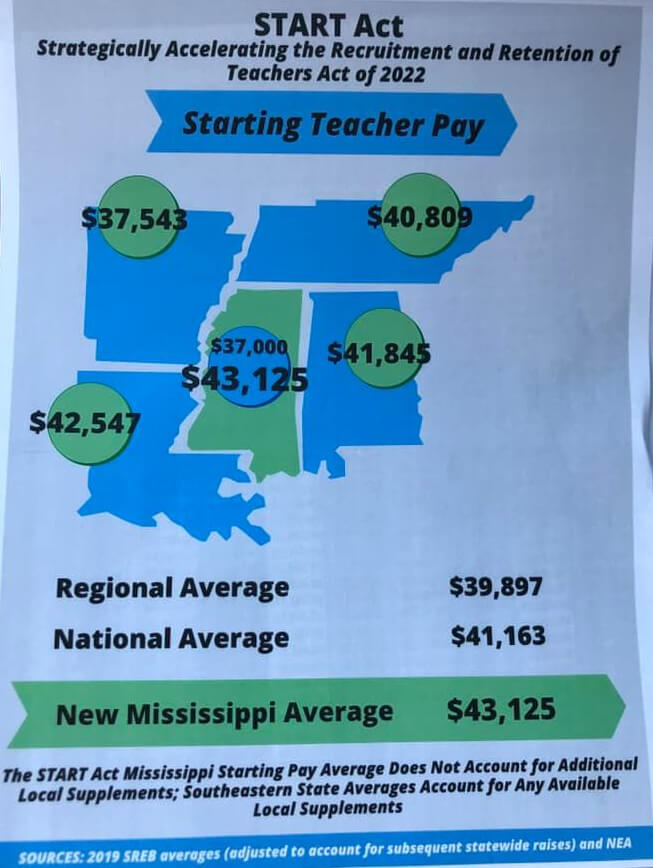

Update Tax Cuts Pay Hikes Highlight House Action Desoto County News

Mississippi To End Mailing Of Income Tax Forms Al Com

Form 80 106 Download Fillable Pdf Or Fill Online Mississippi Individual Fiduciary Income Tax Payment Voucher Mississippi Templateroller

Prepare Your 2021 2022 Mississippi State Taxes Online Now

Mississippi Tax Rate H R Block

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate

States With The Highest Lowest Tax Rates

Mississippi House Takes 1st Step To Approve Tax Cut Plan Press Register

How To Form An Llc In Mississippi Llc Filing Ms Swyft Filings

Mississippi Tax Cuts Battle 5 Things To Know

Mississippi State Tax Commission Seller Sales Tax Number

The Mississippi Republican Income Tax Bet Mississippi Today

Study Mississippi Among Minority Of States Most Dependent On Sales Tax Hubcityspokes

Mississippi Dor Reminds Taxpayers That Income Tax Returns Are Due May 15 Cooking With Salt